In the era of digitalization, payment methods have undergone a significant transformation, particularly in the global business landscape. As key players in the international financial markets, Forex Trading Consultants have embraced digital payment solutions to streamline their operations. The advent of digital currencies and online payment platforms has revolutionized the way these consultants conduct transactions. With seamless cross-border transfers, reduced transaction costs, and increased security, digital payment systems have facilitated efficient Forex trading.

From cryptocurrencies to mobile wallets and online banking, the digitalization of payments has enabled Forex Trading Consultants to transcend geographical barriers, enhance financial efficiency, and capitalize on global opportunities.

How Payment Digitization is Transforming Forex Trading

Increased Efficiency and Speed

Digital payments speed up transactions, crucial in Forex trading, where the market moves rapidly. The elimination of time-consuming traditional banking procedures has been a game-changer.

24/7 Market Access:

Thanks to digital payment systems, Forex markets can now operate round the clock, not being limited by banking hours. Forex trading consultants can provide advice and execute trades anytime, significantly increasing profit opportunities.

Transaction Costs

Digital payments often involve lower transaction costs than traditional methods. Lower costs mean higher profitability, providing both traders and Forex trading consultants an advantage.

Improved Security

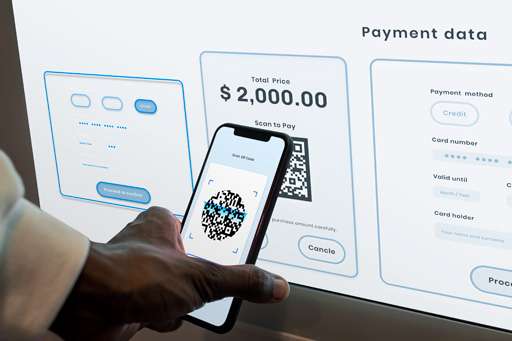

Payment digitalization has made transactions more secure, with robust encryption protocols and two-factor authentication reducing the risk of fraud.

Greater Inclusion

Digital payments have opened up Forex markets to a wider audience. Now, anyone with an internet connection can engage in Forex trading, making the services of Forex trading consultants accessible to a broader range of clients.

Payment Digitalization: The Future of Global Business

For Forex trading consultants, staying ahead of the curve means embracing payment digitalization and all the opportunities it brings. By doing so, they can better serve their clients, helping them navigate the fast-paced world of Forex trading in the digital age.

Payment Digitalization and Forex Trading: A Deeper Dive

Let’s delve deeper into the transformative impact of payment digitalization on Forex trading.

Streamlined Operations and Efficiency

Digitalization of payments provides Forex trading consultants with a streamlined transaction process. This efficiency allows for real-time trading and decision-making, which is crucial in the fast-paced Forex market. With automated digital payments, transactions can be executed promptly, saving valuable time and increasing the efficiency of trading operations.

Enhanced Transparency

Digital payment systems offer a higher level of transparency in transactions. Each transaction is recorded and can be traced, which improves accountability and builds trust between Forex trading consultants and their clients. It also provides an easy way to track and analyze trading patterns, enhancing strategy formulation and decision-making.

The Role of Cryptocurrencies

Cryptocurrencies, a byproduct of digitalization, are making their way into Forex trading. The decentralized nature of cryptocurrencies offers potential advantages such as lower transaction costs and anonymity. However, they also come with their own set of challenges, like price volatility and regulatory concerns. Forex trading consultants, well-versed in these nuances, can guide traders to make informed decisions about incorporating cryptocurrencies into their trading strategies.

Overcoming Challenges in Payment Digitalization

Despite its numerous benefits, payment digitalization also presents challenges, particularly in terms of security and regulatory compliance. Trading consultants play a pivotal role in addressing these challenges, leveraging their expertise to guide secure digital transactions and compliance with financial regulations.

Sum Up

Payment digitalization is a transformative force in the global business environment, shaping the future of Forex trading. Forex trading consultants are essential to this transformation, guiding traders through the digital landscape to seize new opportunities and overcome challenges. As we move forward, the impact of payment digitalization on global business, particularly in Forex trading, will continue to grow.